Economic Abuse Tactics Post-Separation

When direct control is no longer possible. Post-separation economic abuse is a powerful way for abusers to maintain dominance, punish, and destabilize survivors who are working to rebuild their independence.

Economic Abuse Tactics Post-Separation

1. Withholding or Manipulating Child and Spousal Support

- Refusing to pay ordered child support or alimony.

- Making partial, late, or inconsistent payments to keep the survivor financially unstable.

- Quitting jobs or underreporting income to avoid legal obligations.

- Working “under the table” or hiding assets to reduce payment responsibilities.

2. Employment Sabotage

- Harassing the survivor at her workplace (calls, visits, rumors) to cause job loss.

- Contacting her employer with false accusations or defamation.

- Interfering with work schedules or childcare arrangements to jeopardize employment.

3. Credit and Debt Manipulation

- Running up debt in the survivor’s name (identity theft, forged signatures).

- Refusing to pay joint debts, damaging the survivor’s credit score.

- Filing for bankruptcy to shift financial responsibility to the survivor.

- Taking out loans or credit cards using shared information post-separation.

4. Asset Concealment and Manipulation

- Hiding, selling, or transferring shared assets before property settlements.

- Refusing to disclose financial information in divorce proceedings.

- Withholding access to important financial documents or accounts.

- Draining joint bank accounts or emptying retirement funds before separation is final.

5. Housing Instability

- Refusing to leave the marital home but not contributing to expenses.

- Sabotaging rental agreements, utilities, or mortgage payments to force eviction.

- Refusing to sign property transfer or sale documents to delay the survivor’s housing plans.

- Damaging property or refusing to maintain jointly owned homes to lower their value.

6. Interfering with Rebuilding Efforts

- Blocking access to shared benefits, insurance, or tax returns.

- Failing to provide required documentation for taxes or benefits, causing financial penalties.

- Refusing to co-sign or release financial ties that prevent the survivor from moving forward.

7. Using Legal Systems to Create Financial Drain

- Filing frivolous lawsuits, motions, or appeals to force the survivor to pay legal fees.

- Demanding costly mediations or evaluations as a form of financial harassment.

- Refusing to negotiate in good faith, prolonging costly court battles.

8. Weaponizing Children Financially

- Refusing to pay for children’s basic needs (clothes, school supplies, medical care).

- Using money or gifts to manipulate children’s loyalty against the survivor.

- Claiming false financial hardship to reduce support obligations.

9. Sabotaging Recovery and Independence

- Refusing to return personal belongings, work tools, or business materials.

- Interfering with the survivor’s ability to start a new business or career.

- Publicly spreading lies about her finances or character to limit opportunities.

10. Financial Surveillance and Control

- Tracking spending through joint accounts or shared apps.

- Monitoring public records or social media to assess her financial situation.

- Using technology to intimidate or shame the survivor about her income or lifestyle choices.

The Impact

Post-separation economic abuse is intended to:

- Trap survivors in financial dependency.

- Undermine their ability to rebuild stability.

- Keep them emotionally tied to the abuser through ongoing financial stress.

It often forces survivors to choose between safety and survival, which is why it’s recognized as a continued form of coercive control even after the relationship ends.

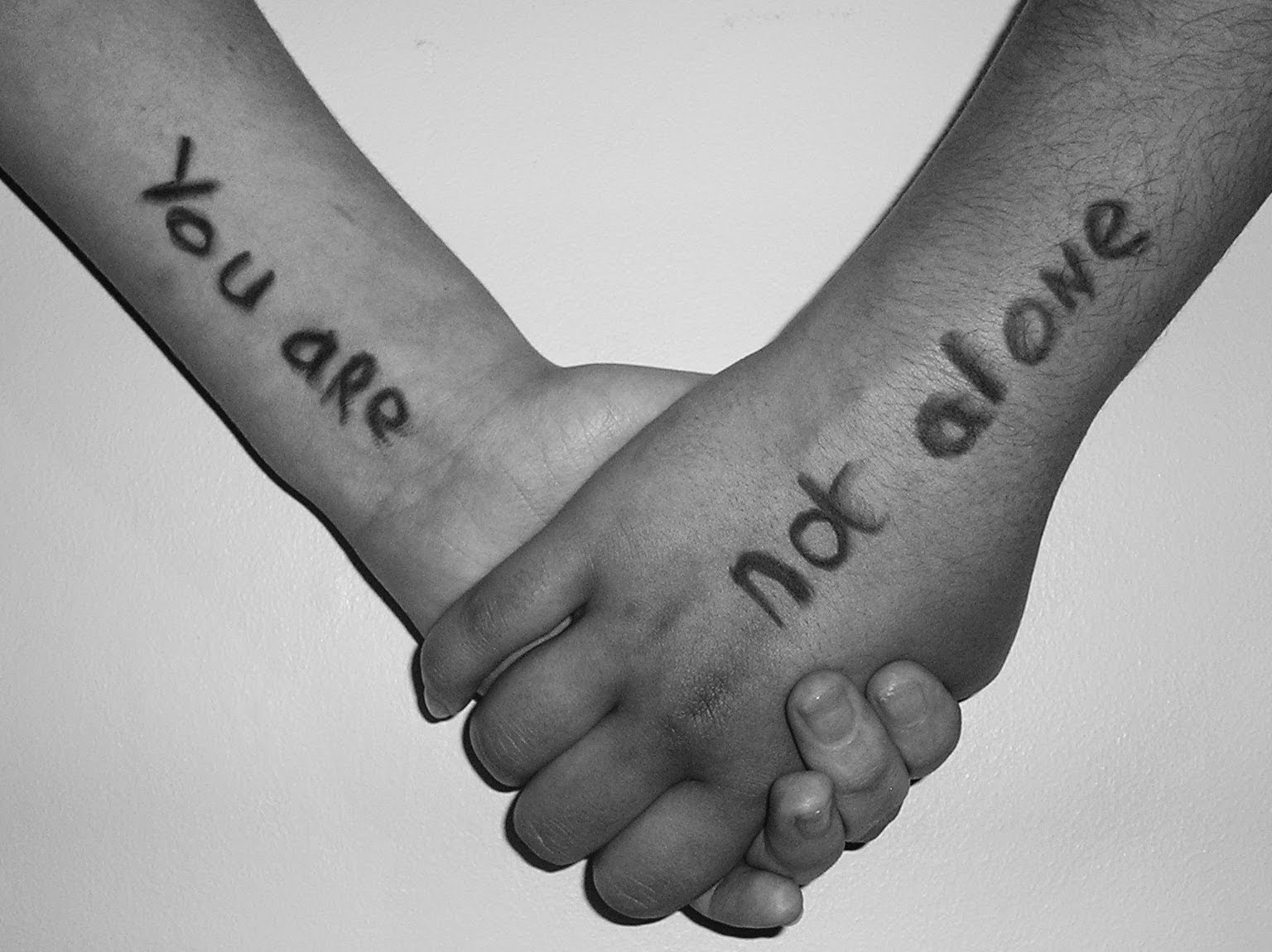

Schedule a Free Discovery Call

Faith-Based Life Coaching for Women Survivors of Abuse